Trading can feel like solving a tough puzzle. Many struggle to find the right tools or signals for better decisions. This guide explains Virgo Global Media Ltd’s technical analysis and shows how its indicators, like RSI and MACD, help traders.

Keep reading—you’ll get smarter about trading today!

Key Takeaways

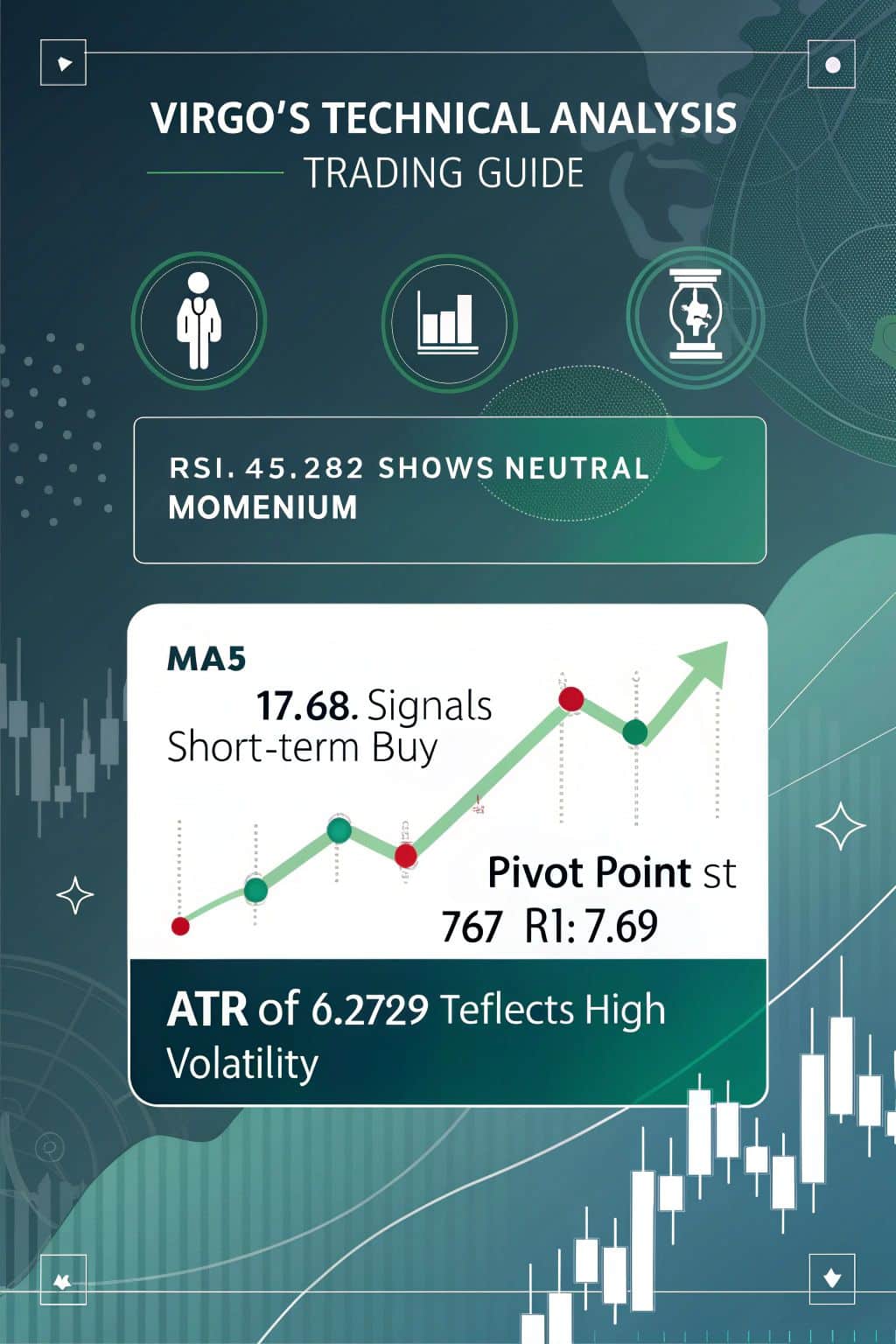

- Virgo Global Media Ltd’s technical analysis uses tools like RSI, MACD, and pivot points to predict market trends. For example, VIRG’s RSI (14) at 45.282 shows neutral momentum, while its MACD (-0.05) signals a strong sell.

- Moving averages are key indicators. The MA5 SMA (7.68) suggests buying, but the EMA (7.73) leans toward selling for short-term trends.

- Pivot points guide traders in spotting support and resistance levels. Classic pivot for VIRG is 7.67 with S1 at 7.64 and R1 at 7.69.

- High volatility surrounds VIRG stock with an ATR of 0.2729, reflecting sharp price swings that impact trading strategies.

- Traders should combine tools like RSI, STOCHRSI (at oversold level of 7.286), and candlestick patterns to identify opportunities or limit risks effectively in volatile markets.

Overview of Technical Indicators

Technical indicators help traders understand price patterns and market signals. They act as tools to predict potential movements in stocks or assets.

Moving Averages

Moving averages smooth out price data to show trends clearly. Simple Moving Averages (SMA) take the average of prices over a set time, while Exponential Moving Averages (EMA) give recent prices more weight.

VIRG’s MA5 shows mixed signals: SMA is 7.68 (Buy), but EMA is 7.73 (Sell). For MA200, both SMA at 8.45 and EMA at 8.41 suggest selling.

“Trends are your friends—until they end.”

This tool helps identify bullish or bearish trends in stocks like VIRG. Short-term averages, such as MA10-SMA at 7.88 and EMA at 7.80, signal selling pressure now dominating the market trend.

Pivot Points

Traders use pivot points to spot key price levels. They act as markers for potential support and resistance. For Virgo Global Media Ltd (VIRG), the classic pivot is 7.67, with S1 at 7.64 and R1 at 7.69.

Fibonacci shows the same pivot but sets S1 at 7.65.

Camarilla keeps its pivot the same yet mirrors S1 and R1 at 7.65 each time. Woodie’s values are slightly different, placing the pivot lower at 7.66 with R1 also matching it, but pushing S1 down to 7.62 for analysis precision in volatile markets like cryptocurrencies or high-volatility stocks such as VIRG trends reveal!

RSI (Relative Strength Index)

RSI (Relative Strength Index) measures stock momentum. It shows if a stock is overbought or oversold, helping traders spot trends. An RSI value ranges from 0 to 100. Levels near 70 suggest overbought conditions, while below 30 indicates oversold areas.

For Virgo Global Media Ltd., the RSI (14) sits at 45.282, falling in the neutral zone.

This neutral reading reflects balanced buying and selling activity for VIRG’s stock. Combined with other indicators like STOCHRSI showing an oversold level of 7.286, it points toward potential trend reversals or opportunities in high volatility markets like this one next analyzed through MACD tools and signals ahead!

MACD (Moving Average Convergence Divergence)

The MACD is a vital tool in technical analysis. It measures the strength and direction of trends. For Virgo Global Media Ltd (VIRG), the MACD (12,26) stands at -0.05, signaling a *sell*.

This negative value hints that bearish momentum dominates right now. Retail traders often use this data to confirm downward pressure.

This indicator works by subtracting two moving averages: 26-EMA from 12-EMA. The result helps traders spot possible shifts in trend direction early on. A signal line also plays its part here—it smooths fluctuations for better clarity during high volatility periods or unstable stock market conditions like today’s scenario with VIRG showing oversold levels on other indicators too.

Markets are stories told by numbers.

Detailed Analysis of Virgo Global Media Ltd (VIRG)

Get ready to explore Virgo Global Media Ltd’s (VIRG) price patterns, stock behavior, and market trends for smarter trading moves.

Weekly Technical Analysis

Weekly technical analysis breaks down short-term stock activities. It highlights key market trends and trading signals for better decision-making.

- Closing Price Analysis

Virgo Global Media Ltd’s last closing price was 7.59 INR on November 29, 2024. The stock dropped by -0.37 INR, showing a loss of -4.65%.

- Day’s Range Insights

Prices fluctuated between 7.57 INR and 8.30 INR during the day. This reflects high volatility in trading patterns.

- 52-Week Highs and Lows

Over the year, VIRG reached a high of 13.25 INR and a low of 4.97 INR. Such a wide range indicates sharp market movements.

- Key Sell Signals

Technical indicators provided strong sell signals with only one buy signal versus eleven sell signals recorded last week.

- Pivot Points for Trading

Pivot points suggest possible price reversal zones for traders to watch closely in the coming weeks.

- Trend Overview

Current data shows bearish trends dominating the market behavior of VIRG stock.

- Moving Average Stats

Classic moving averages indicate a declining pattern that aligns with bearish sentiment in the financial markets.

- RSI Observations

A weak RSI suggests overselling pressure on VIRG’s stock, supporting negative movement predictions ahead.

- Impact of High Volatility

High volatility spotted within recent trades can lead to quick gains or losses for retail traders and investors alike.

- Technical Summary Notes

With a “strong sell” summary, it’s critical for retail traders to act cautiously when dealing with this stock today.

Key Price Levels and Pivot Points

Finding key price levels and pivot points helps traders spot trends and make moves. They guide decisions on buying, selling, or holding stocks like Virgo Global Media Ltd (VIRG).

- Classic Pivot Points

These give three main levels: support (S1), pivot, and resistance (R1). For VIRG, S1 is 7.64, the pivot stands at 7.67, and R1 is 7.69. Traders often use these levels to predict price movements throughout the day.

- Fibonacci Pivot Points

Based on Fibonacci ratios, these levels are vital for tracking retracement zones. For VIRG, S1 is 7.65, with a pivot of 7.67 and R1 at 7.69.

- Camarilla Pivot Points

Unlike others, this model focuses on smaller movement ranges in high volatility markets. VIRG’s S1 sits at 7.65, pivot remains at 7.67, while R1 aligns closely with support at 7.65.

- Woodie’s Pivot Points

Calculated differently for active market traders looking for dynamic changes daily—VIRG has S1 at 7.62 versus the more common value system above.

- DeMark’s Levels

These hinges depend solely upon yesterday closing prices across U.S segments-Assigning Pivotal values from Internal retention methodology’)}>

Analysis of Market Trends and Stock Behavior

Virgo Global Media Ltd shows neutral momentum with an RSI of 45.282. The Ultimate Oscillator signals a “Buy” at 54.929, suggesting potential upward movement. Meanwhile, the Rate of Change (ROC) is -3.75, leaning toward a “Sell.” High volatility surrounds the stock as ATR stands at 0.2729.

Bearish signs include Bull/Bear Power (-0.372), indicating selling pressure and Williams %R (-84.337), reflecting oversold conditions. These factors may hint at weaker investor confidence for now but could open short-term trading opportunities ahead under specific strategies focused on such volatile patterns!

Trading Signals for VIRG

Spotting trading signals can feel like solving a puzzle. They show when to buy, sell, or wait in the fast-moving stock market.

Buy, Sell, and Hold Signals

Trading decisions depend on clear buy, sell, or hold signals. These signals guide traders based on stock performance and technical analysis.

- Buy Signals

- Occur when a stock shows potential gain.

- VIRG has just 1 buy signal, indicating weak upward momentum.

- Moving averages crossing upward can confirm a buy opportunity.

- Sell Signals

- Arise when prices might drop further.

- With 11 sell signals, VIRG strongly suggests selling now to cut losses.

- RSI below 30 can reinforce a strong sell due to overselling pressure.

- Hold Signals

- Recommend waiting when markets are unclear.

- For VIRG, low market volatility or neutral trend supports holding instead of hasty moves.

Market trends impact daily trading outcomes.

Classic and Exponential Moving Averages

Jumping from buy, sell, and hold signals, let’s break down how Classic (Simple) and Exponential Moving Averages (EMAs) work. They’re not just numbers; they’re tools traders lean on to spot trends. Below you’ll see a simple table summarizing vital data for VIRG’s moving averages.

| Time Period | Simple Moving Average (SMA) | Exponential Moving Average (EMA) | Signal |

|---|---|---|---|

| MA5 | 7.68 | 7.73 | SMA: Buy | EMA: Sell |

| MA10 | 7.88 | 7.80 | SMA: Sell | EMA: Sell |

| MA20 | 7.95 | 7.83 | SMA: Sell | EMA: Sell |

SMAs calculate the average price over a set time. It’s straightforward and smooths out data. For VIRG, the SMA suggests a sell signal for MA10 and MA20. Meanwhile, the short-term MA5 SMA flashes a buy signal.

EMAs, on the other hand, give more weight to recent prices. They’re quicker to reflect sudden changes. For VIRG, EMA readings across MA10 and MA20 point to sell signals. The MA5 EMA also aligns with a sell.

Comparing both types, notice the SMA’s slower reactions, especially on longer periods like MA20. EMAs are more sensitive and react faster to shifting market conditions. This makes them a favorite for traders seeking short-term signals.

Each method offers unique advantages. The simple type is less affected by outliers. The exponential type, though, excels in spotting recent trends.

Stochastic Oscillators and ATR (Average True Range)

Stochastic Oscillators and ATR (Average True Range) are essential tools for traders. They offer insights into volatility and momentum. Below is a quick breakdown of these two indicators and their relevance to Virgo Global Media Ltd (VIRG):

| Indicator | Description | VIRG Insights |

|---|---|---|

| Stochastic Oscillators (STOCH 9,6) | Measures momentum and identifies overbought or oversold conditions. Values range from 0-100. Below 20 is oversold, above 80 is overbought. | Current reading: 14.294. VIRG is oversold, suggesting a potential reversal or value-buying zone. |

| Stochastic RSI (STOCHRSI 14) | A more sensitive momentum oscillator. Tracks RSI changes in overbought/oversold conditions. | Current reading: 7.286. VIRG is deep in oversold territory, reflecting potential trend exhaustion downward. |

| Average True Range (ATR 14) | Gauges volatility by calculating the average range between high and low prices over a set period. | Current ATR: 0.2729. High volatility signals rapid price fluctuations for VIRG. |

Trading Strategies Based on Technical Analysis

Trading without a solid plan is like sailing without a compass. Learn how to spot trends, manage risks, and make confident moves in high-volatility markets.

Establishing Entry and Exit Points

Setting clear entry and exit points is vital for success. It reduces risks and maximizes profits.

- Identify Key Support and Resistance Levels

Use pivot points to spot support (S) and resistance (R) levels. For instance, VIRG shows S1 at 7.64, Pivot at 7.67, and R1 at 7.69 in the Classic chart. These guide where prices may bounce or reverse.

- Monitor Technical Indicators

Watch RSI for overbought or oversold zones. An RSI above 70 signals a possible sell point; below 30 suggests a buy opportunity. Pair RSI with MACD for stronger signals.

- Follow Moving Averages

Track SMA (Simple Moving Average) and EMA (Exponential Moving Average). Crossovers of these lines often hint at market trends shifting up or down.

- Use ATR for Volatility

Measure market volatility using ATR (Average True Range). High ATR values often indicate larger price swings, critical for setting stop losses.

- Set Stop Losses Smartly

Always decide your risk tolerance before entering trades. Placing stop-loss orders slightly below S1 or above R1 can help limit financial risks from high volatility.

- Plan Targets Based on Fibonacci Levels

Use Fibonacci retracement levels like S1: 7.65 and R1: 7.69 as profit targets depending on price movements toward upward or downward trends.

- Watch Candlestick Patterns Closely

Observe charts for formations like engulfing candles or doji patterns, which often predict reversals in bullish or bearish trends.

- Assess Short vs Long-Term Goals

Short-term traders may enter based on quick-moving indicators like Stochastic Oscillators, while long-term traders might rely more on broader MA trends paired with economic calendar events.

- Consider Market Data Triggers

Check factors like Brent oil prices, currency fluctuations using a currency converter, or major S&P 500 shifts to validate entry/exit timing amid market changes.

- Practice Risk Management Always

Avoid trading all funds at once or using high leverage while trading on margin to minimize potential losses during unexpected trends.

Risk Management Techniques

Risk management keeps traders from huge losses. Smart traders use strategies to protect their money.

- Set Stop-Loss Orders

Protect your trade with stop-loss orders. For instance, if Virgo’s stock drops below a key price level, you sell automatically to limit loss. Use ATR (14) at 0.2729 to set precise levels during high volatility.

- Position Sizing

Never risk too much on any trade. Keep each position size small, like 1-2% of your total capital. This reduces damage even if the market goes south.

- Diversify Investments

Don’t put it all into one stock like VIRG. Spread funds across ETFs or stocks with low correlation to reduce risk.

- Use Risk-Reward Ratios

Aim for trades with at least a 1:2 risk-reward ratio. For example, if risking $100, expect $200 in returns before entering the trade.

- Monitor Volatility Levels

High volatility signals bigger risks and rewards in trading VIRG (e.g., ATR at 0.2729). Adjust your strategy based on the market’s ups and downs.

- Stick to Your Plan

Follow pre-set entry, exit points, and rules strictly—don’t act on emotions or market fear-driven decisions.

- Avoid Overtrading

Trading too often increases chances of errors and costs more fees on platforms like those available on Google Play or Forex brokers’ sites.

- Track Pivot Points Weekly

Keep an eye on key pivot points in VIRG analysis to identify strong buy/sell signals early.

Each tip plays a role in safer trading while staying prepared for surprises in volatile markets like BSE or forex trading platforms.

Utilizing Technical Analysis for Short and Long Term Trades

Analyze VIRG using moving averages for short trades. The 14-day RSI at 45.282 hints neutrality, but Williams %R at -84.337 shows oversold conditions. This signals a potential upward movement soon.

Combine this with pivot points to spot quick gains.

For long-term trades, track the MACD indicator and market highs/lows for trends. A bullish trend backed by the Ultimate Oscillator reading of 54.929 suggests holding positions or preparing to buy during pullbacks in value areas.

Monitor candlestick charts to confirm entries or exits efficiently.

FAQs on Virgo’s Technical Analysis

Curious about technical indicators or market signals for VIRG? Check out these FAQs to clear your doubts and trade smarter!

Common Questions About Technical Indicators

Technical indicators help traders make decisions. They simplify complex market data into useful signals.

- What is RSI (Relative Strength Index)?

RSI measures stock momentum. It tells if a stock is overbought or oversold on a scale of 0-100. For example, if RSI is 45.282, like VIRG’s current value, it shows neutral momentum.

- How do Moving Averages work?

Moving averages smooth price trends by showing the average closing price over a set time period. They reveal bullish or bearish movements and help plan entry or exit points.

- Why are Pivot Points important?

Pivot points mark key price levels for support and resistance in trading. Traders use these levels to spot possible market reversals or breakouts in high volatility environments.

- What does MACD (Moving Average Convergence Divergence) indicate?

MACD compares two moving averages to show trend direction and strength. When lines cross, it signals potential buy or sell opportunities based on stock behavior.

- Can STOCH help find oversold stocks?

Yes! STOCH checks if prices are near recent highs or lows, highlighting oversold conditions like VIRG’s STOCH at 14.294. This can signal possible upward movement soon.

- Is ATR (Average True Range) useful for risk management?

ATR calculates market volatility by tracking daily price ranges. Higher ATR means more risk but also higher reward potential during trades.

- What makes ADX (Average Directional Index) valuable?

ADX measures trend strength without focusing on direction. High values suggest strong trends; low values imply weaker trends or sideways movement.

- How does Bull/Bear Power apply to decisions?

Bull/Bear Power monitors buying and selling pressure to spot market shifts ahead of time, helping traders identify undervalued stocks early.

- Are technical indicators enough alone?

No, combining them with tools like economic calendars and peer valuation multiples gives better results for both short-term trading and long-term investment strategies.

- Why use multiple indicators together?

Each tool has limits; using RSI with pivot points or STOCH can confirm signals before acting on them for better accuracy in trades.

- Do dividend models fit technical analysis?

Dividend discount models don’t directly link but can aid in understanding fair value compared to technical signals from charts and data trends.

- Can beginners rely only on online trading platforms?

Online platforms are handy but shouldn’t replace learning key concepts like CCI (Commodity Channel Index), yield curves, or discounted cash flow analysis for smarter trades!

Understanding Market Signals in the Context of VIRG

Market signals for VIRG point to a bearish trend. The MACD (12,26) shows -0.05, indicating a sell signal as the moving average crosses downward. ADX (14) reads 48.637, suggesting strong directional movement favoring sellers.

CCI (14) is at -91.5854, further confirming selling pressure in the short term.

High volatility may impact quick price shifts for traders watching pivot points and RSI levels closely. A stock screener can help spot undervalued stocks or those falling below fair value benchmarks swiftly.

These tools guide buy, sell, or hold decisions while limiting risk with ATR calculations during uncertain periods of trading on platforms like BSE markets or beyond stablecoins like USDT investments strategy trends today!

Conclusion

Mastering technical analysis with Virgo Global Media Ltd can reshape your trading game. Use tools like RSI, MACD, and pivot points to uncover opportunities in volatile markets. Apply these insights for smarter trades and better timing.

Grab the 60% discount to explore advanced features today! The right strategies now could mean big wins later.

For more insights on diversifying your investment portfolio with cryptocurrencies, check out our guide to Libra’s Balanced Crypto Portfolio.

FAQs

1. What is technical analysis, and how does it help in trading?

Technical analysis uses charts, patterns, and indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and moving averages to predict price movements. It helps traders make informed decisions during high volatility or when spotting undervalued stocks.

2. How do pivot points and highs/lows factor into trading strategies?

Pivot points are key levels that show potential market direction changes. Highs and lows reveal trends, helping traders identify strong sell signals or opportunities in overvalued stocks.

3. Can I use Virgo’s guide for option trading on the Bombay Stock Exchange (BSE)?

Yes! The guide covers tools like ADX (Average Directional Index) and ATR (Average True Range) that can be applied to options trading on BSE or other markets with high volatility.

4. What role do valuation models play in this guide?

Valuation models such as discounted cash flow, dividend discount models, and peer valuation multiples help determine fair value for assets. This ensures smarter investments by identifying whether a stock is overvalued or undervalued.

5. Are there additional investment tools included in the guide?

Absolutely! Tools like stock screeners, an economic calendar for tracking events, CCI (Commodity Channel Index), bull/bear power metrics, and more are part of the toolkit to refine your strategy further.