Managing a crypto portfolio can feel confusing, especially with so many options out there. Libra cryptocurrency, later called Diem, aimed to make digital transactions simple and low-cost.

This guide will show you how to balance your assets using strategies inspired by Libra’s design. Keep reading to learn practical tips for smarter investing!

Key Takeaways

- Libra, now called Diem, was designed as a stable digital currency backed by assets like USD and EUR. It aimed to lower costs and make global transactions easier.

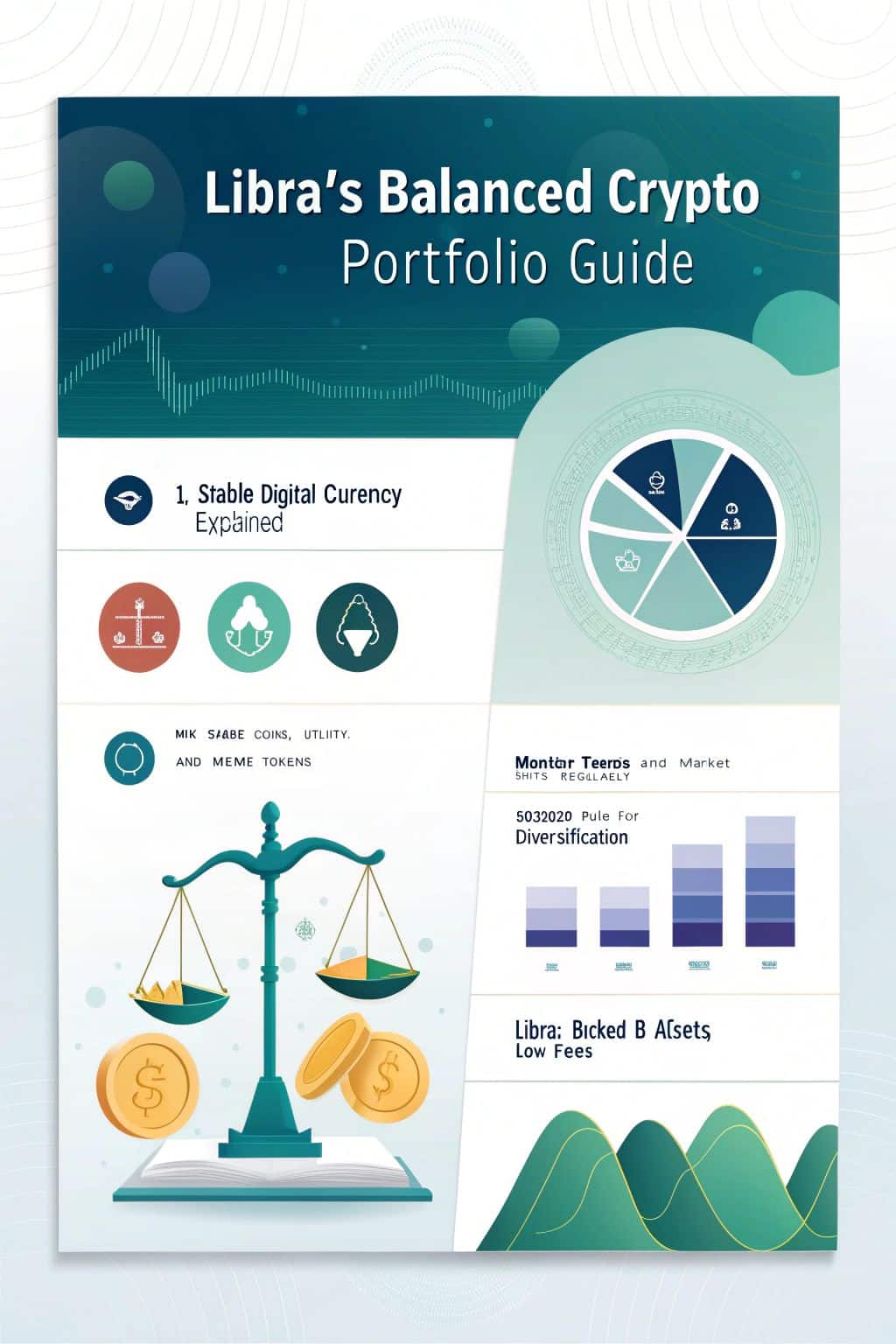

- Balancing crypto portfolios involves mixing stablecoins like Libra with utility coins (e.g., SUI) and meme tokens (e.g., DOGE). This reduces risk while capturing growth opportunities.

- Stability in Libra came from its backing by real assets and low gas fees. Its design targeted developing countries with limited banking access.

- Regular portfolio monitoring is key due to fast-changing market trends and regulatory shifts that can impact returns or security.

- Diversifying investments into 50% stable options (like Libra), 30% utility coins, and 20% meme tokens provides balance for both long-term stability and short-term profit potential.

Overview of Libra/Diem Cryptocurrency

Libra, now called Diem, is a digital currency aimed at simple and fast transactions. It uses private blockchain technology to lower costs and avoid high gas fees.

Key Features

Diem, once known as Libra, was built on private blockchain technology. It aimed to become a stable digital currency. Backed by assets like USD, EUR, and GBP, it offered consistency in value compared to volatile cryptocurrencies.

Gas fees were minimal due to its secure network design.

Users could buy and store tokens using cryptocurrency wallets tied to the Diem association’s system. Its medium of exchange function targeted developing countries with limited access to banking services.

Controlled by trusted bookkeepers within the Libra Association, it prioritized transparency and financial inclusion.

A digital currency backed by stability can truly change finance for everyone.

Purpose and Design

Libra cryptocurrency aimed to create a global payment system. It wanted to help 1.7 billion adults without bank access but who own mobile phones. Its design offered low-fee digital transactions, making it great for users in developing countries with high remittance costs.

The Libra Association managed its token security and supply. They planned a stablecoin tied to multiple currencies like the US dollar and euro. This multi-currency approach increased stability compared to other crypto assets.

The goal was simple—combine blockchain technology with ease of use for cash-like payments worldwide.

Comparing Libra with Other Cryptocurrencies

Libra stands out with its focus on stability and everyday use, unlike many volatile digital coins. Its design aims to serve both tech enthusiasts and people in developing countries seeking practical financial tools.

Stability Features

Backed by real assets like currencies and debt instruments, Libra was built for price consistency. Unlike Bitcoin or other volatile cryptocurrencies, it aimed to maintain steady value.

The Diem Association oversaw its reserves and adjusted the token supply as needed. This balance helped protect users from sharp market swings.

Its design made transactions affordable with lower fees. This feature appealed to people in developing countries seeking cost-effective ways to trade or transfer money. “Stablecoins can bridge gaps in global financial systems,” developers often said about Libra’s mission to offer stability through blockchain technology.

Utility in the Market

Libra cryptocurrency focuses on digital transactions through mobile devices. It aims to cut transaction costs while boosting financial access. Blockchain technology powers this system, offering speed and security for users.

Its design serves developing countries where banking access is limited. The Libra Association plans to earn revenue from interest on reserve assets. Wider adoption means higher reserves, creating more benefits for partners over time.

Strategies for Balancing Memes and Utility Coins

Memes bring fun, but utility coins drive purpose. Balancing both can boost your portfolio and keep it adaptable.

Diversification Benefits

Spreading your investments can lower risks. Stablecoins like Libra cryptocurrency provide steadiness during market swings. Backed by major currencies, it acts as a cushion. This helps protect against sharp drops in value.

Balancing meme coins and utility coins adds more benefits. Coins like DOGE bring high-risk, high-reward potential. On the other hand, tokens such as SUI or DTX Exchange offer practical uses on blockchain technology.

Mixing these creates a stronger portfolio adaptable to changes in the market.

Examples: DOGE, SUI, and DTX Exchange

Meme coins and utility tokens create balance in portfolios. Each type serves a different purpose and can reduce risks.

- DOGE (Dogecoin)

Born as a joke, Dogecoin is now widely traded. It thrives on high market hype and internet culture. Elon Musk’s tweets often cause price spikes. While its use case is limited, it’s great for short-term gains due to high volatility.

- SUI Coin

Built on new blockchain technology, SUI focuses on speed and low costs. Its design benefits developers in creating faster apps for users. Strong backing by tech experts also makes SUI attractive for steady growth investments in developing countries.

- DTX Exchange Token

Used within the DTX crypto exchange, this token powers transactions. Holders get perks like lower fees and rewards on trades. Its stable demand comes from platform users, offering utility-driven value ideal for long-term plans.

Choosing between these depends on your goals—short bursts of profit or solid utility over time—leading us to explore portfolio risk management next!

Expert Advice on Risk Management in Crypto Portfolios

Managing risk in crypto is like walking a tightrope—balance is key. Focus on staying calm and making smart moves, even when markets swing wildly.

Assessing Volatility

Volatility shakes the crypto market. Some coins jump wildly in value, making them risky. Libra cryptocurrency reduces this risk with its stablecoin design. It ties to major currencies like the dollar and euro to keep its value steady.

This backing protects users from sudden price crashes or spikes.

Libra’s stability attracts cautious investors. The Libra Association aims for less fluctuation compared to meme coins like DOGE or utility tokens like SUI. Developing countries could benefit most by using such a reliable currency for daily transactions or savings without fear of losing money overnight.

Long-term vs Short-term Investments

Long-term investments in Libra cryptocurrency might reward patience. Stakeholders could earn profits through interest from reserve assets. This appeals to those eyeing steady growth and financial inclusion for unbanked populations, especially in developing countries.

Regulatory challenges may impact these plans but offer a chance at higher rewards over time.

Short-term investors may benefit from lower transaction costs with Libra’s stablecoin design. Unlike volatile cryptocurrencies, it provides more predictable trading options. Quick trades and market opportunities suit this strategy while keeping risks manageable.

Understanding both approaches paves the way to smarter allocation strategies next.

How to Optimize Your Crypto Portfolio with Libra

Balancing your crypto assets with Libra can simplify the process. Smart allocation and regular checks keep your portfolio steady and growing.

Allocation Strategies

Split your portfolio into stablecoins, utility coins, and meme tokens. Libra cryptocurrency offers stability due to its design as a multi-currency stablecoin. This makes it fit well for the stable portion of your investments.

Use 50% on stable options like Libra and DTX exchange tokens to reduce risk.

Allocate 30% to strong utility coins like SUI for growth potential. These can adapt quickly in a changing market. The remaining 20% works best with high-risk, high-reward assets such as DOGE.

A balanced strategy helps shield against volatile shifts while capturing profits.

Monitoring and Adjusting

Track portfolio changes often. Cryptocurrency’s value shifts quickly. Libra cryptocurrency, managed by the Diem Association, had a design to reduce risk with stability features. But even stable options need monitoring due to market trends and regulatory updates.

Inconsistent app developers and policy changes also affected tokens like Libra in developing countries.

Adjust allocations based on performance and news. For instance, rebalance utility coins like Diem if they outperform meme coins such as DOGE for extended periods. Check blockchain technology updates or industry events impacting asset returns or security issues tied to apps or wallets used.

Fine-tuning ensures better control over risks ahead of new investments.

Conclusion: Achieving Portfolio Balance with Libra

Balancing your crypto portfolio can feel tricky, but Libra’s ideas make it simpler. Its stable design and global focus once aimed to reduce risk and boost access for all users. By mixing steady assets like Libra with utility coins, you could aim for both stability and rewards.

Watch the market, adjust wisely, and aim for balance. Let your portfolio work smarter, not harder!

For more insights on how psychological factors influence cryptocurrency trading decisions, check out our guide on Scorpio’s crypto trading psychology.

FAQs

1. What is Libra cryptocurrency, and how does it work?

Libra cryptocurrency is a digital currency developed with blockchain technology. It aims to provide fast, low-cost transactions, especially in developing countries where access to traditional banking may be limited.

2. How does the Libra Association manage its crypto portfolio?

The Libra Association oversees the development of the currency and ensures its stability through a balanced reserve backed by real-world assets like cash and government securities.

3. Can blockchain technology in Libra help people in developing countries?

Yes, blockchain technology allows secure and transparent transactions. This can empower individuals in developing countries by providing financial tools without relying on banks.

4. Are there tax implications when using or investing in Libra cryptocurrency?

Yes, taxes apply depending on your country’s laws. Gains from trading or holding Libra may be taxed as income or capital gains based on local regulations. Always consult a tax professional for guidance.